Published January 30, 2026

The Credit Score Myth That’s Holding Would-Be Buyers Back

Many would-be homebuyers in Riverside County aren’t sitting on the sidelines because they don’t want to buy; they’re waiting because they believe they can’t. And for a lot of people, their credit score feels like the biggest obstacle.

According to a Bankrate survey, 42% of Americans believe you need excellent credit to qualify for a mortgage. That misconception comes up often when renters are asked why they haven’t bought yet. “My credit isn’t good enough” is one of the most common answers.

Maybe that sounds familiar. You check your credit score, see it’s not perfect, and assume buying your first home just isn’t realistic right now, especially with home prices and interest rates being what they are.

But here’s what many buyers don’t realize.

You Don’t Need Perfect Credit to Buy a Home

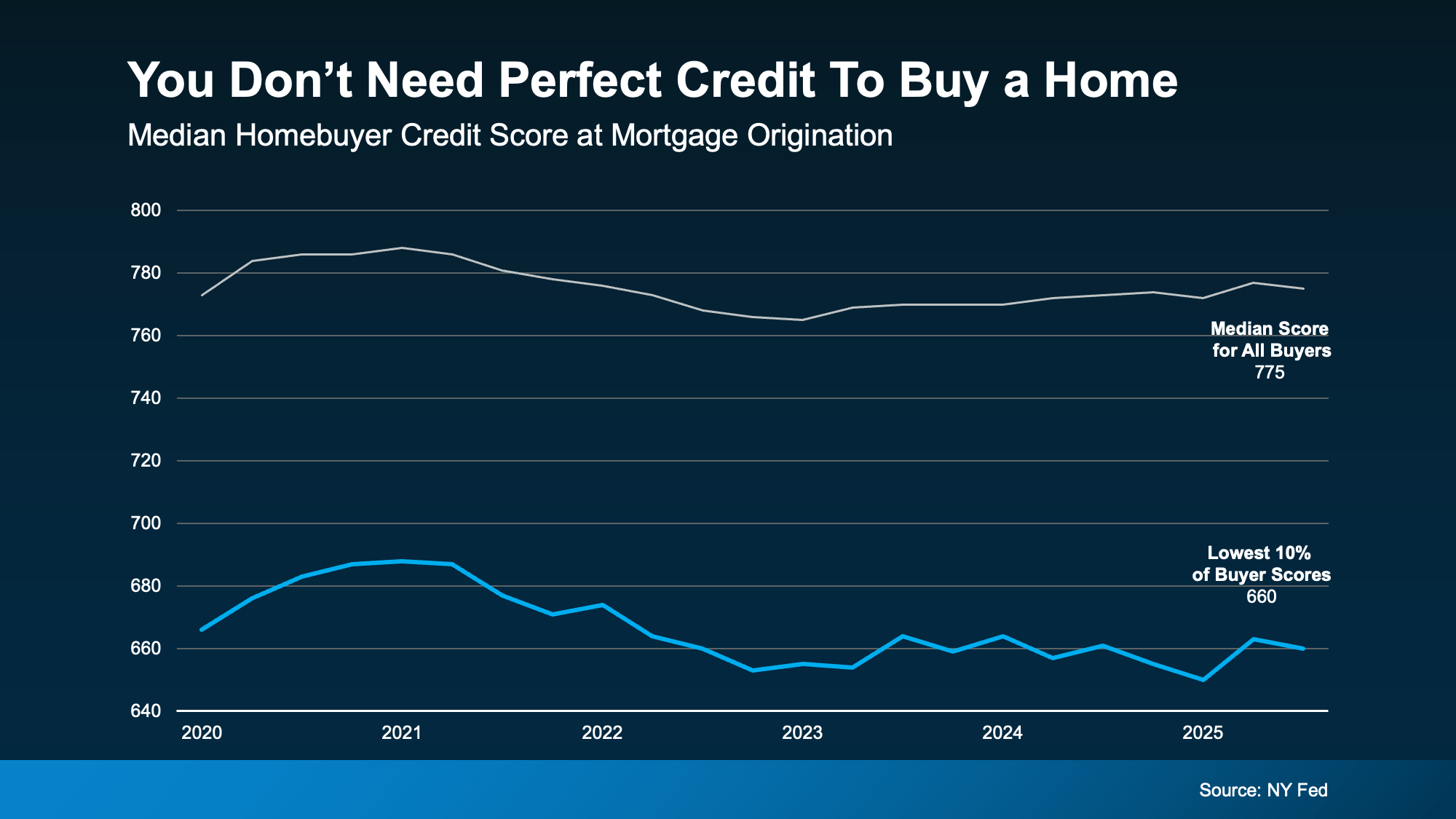

A big part of this myth comes from the fact that today’s average homebuyer does tend to have strong credit. According to data from the New York Fed, the median credit score for recent homebuyers is around 775.

But that number doesn’t represent the minimum needed to qualify.

In reality, recent buyer data shows that not everyone buying a home has a credit score that high. About 10% of buyers had scores around 660, meaning many were approved with credit below what most people assume is required (see graph below):

So if your score isn’t where you want it to be yet, that doesn’t automatically close the door on buying, even in competitive local markets like Murrieta, Temecula, and nearby Riverside County communities.

There’s No Universal “Cutoff” Score

Another important thing to know: there is no single credit score requirement that applies to all buyers.

As FICO explains, there is no universal credit score you absolutely have to have when buying a home:

“While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy, including the level of risk it finds acceptable. There is no single ‘cutoff score’ used by all lenders, and there are many additional factors that lenders may use . . .”

In other words, different lenders have different guidelines, loan programs, and flexibility, especially for first-time buyers.

That’s why the best next step isn’t guessing or assuming, it’s having a conversation with a trusted local lender who can look at your full financial picture, not just one number.

Why This Matters for Local Buyers

In Riverside County, many buyers are balancing affordability, commuting needs, and long-term goals. Waiting on the sidelines because of a credit myth can mean missing opportunities, especially as inventory and buyer demand shift.

The truth is, buyers with credit scores in the 600s are successfully purchasing homes every year. And in many cases, a lender can also help you understand:

-

What loan programs you may qualify for

-

Whether a small credit improvement could make a big difference

-

What steps to take if you’re not quite ready yet

You don’t need to have everything figured out to start that conversation.

Bottom Line

Your credit score matters, but it doesn’t have to be perfect to buy a home.

If credit concerns have been the reason you’ve been waiting, now may be the right time to take another look at what’s possible. Talking with a local lender can give you clarity, options, and a realistic path forward.

Sometimes the hardest part is just starting the conversation.